Car Insurance for a 1998 Toyota Avalon Xl Sedan

1999 Toyota Avalon Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

| Jeffrey Johnson graduated summa cum laude from the University of Baltimore School of Law and has worked in legal offices and nonprofits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman University and worked in film, education, and publishing. His professional writing has appeared on sites like The Manifest and Vice, and he is the author of a novel ... Full Bio → | Written by |

UPDATED: Nov 23, 2017

Advertiser Disclosure

It's all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don't influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

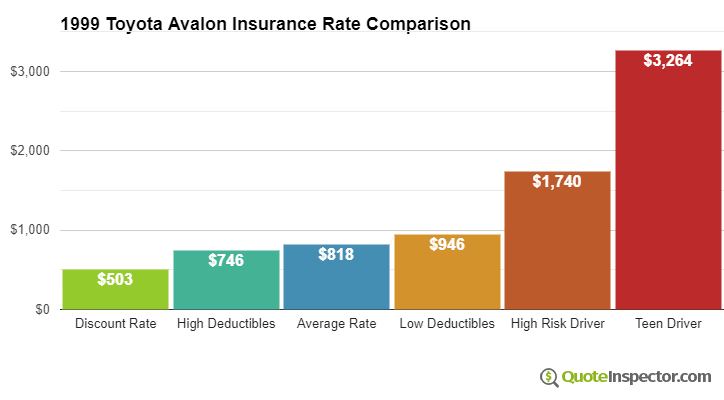

Average insurance rates for a 1999 Toyota Avalon are $818 a year with full coverage. Comprehensive insurance costs on average $144, collision costs $162, and liability insurance costs $376. Buying a liability-only policy costs as little as $426 a year, with high-risk insurance costing $1,740 or more. Teenage drivers receive the highest rates at $3,264 a year or more.

Annual premium for full coverage: $818

Rate estimates for 1999 Toyota Avalon Insurance

Comprehensive $144

Collision $162

Liability $376

Rate data is compiled from all 50 U.S. states and averaged for all 1999 Toyota Avalon models. Rates are based on a 40-year-old male driver, $500 comprehensive and collision deductibles, and a clean driving record. Remaining premium consists of UM/UIM coverage, Medical/PIP, and policy fees.

Price Range by Coverage and Risk

For a middle-aged driver, prices range go from as low as $426 for just liability insurance to a much higher rate of $1,740 for a high risk driver.

Liability Only $426

Full Coverage $818

High Risk $1,740

View Chart as Image

These differences demonstrate why anyone shopping for car insurance should compare rates based on a specific location and risk profile, rather than relying on average rates.

Use the form below to get rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Recommended Companies for Cheap 1999 Toyota Avalon Insurance

Searching Companies

Trying to find cheaper insurance coverage rates? Buyers have lots of choices when searching for affordable Toyota Avalon insurance. You can either spend your time calling around getting price quotes or save time using the internet to get rate quotes. There is a right way and a wrong way to find insurance coverage online so we're going to tell you the proper way to quote coverages for a Toyota and locate the lowest possible price.

Pay less for 1999 Toyota Avalon insurance

Car insurance companies don't always list every discount in a way that's easy to find, so here is a list some of the more common and also the lesser-known discounts you could be receiving. If you aren't receiving every discount you deserve, you are throwing money away.

- Multi-policy Discount – When you combine your home and auto insurance with the same company you may save approximately 10% to 15%.

- Good Student Discount – Performing well in school can be rewarded with saving of up to 25%. This discount can apply up to age 25.

- College Student – Youth drivers who attend school more than 100 miles from home and do not have a car can be insured at a reduced rate.

- Passive Restraints – Cars that have air bags or automatic seat belts may earn rate discounts of more than 20%.

- Low Mileage – Fewer annual miles on your Toyota could qualify for lower rates on the low mileage vehicles.

- Anti-lock Brake Discount – Vehicles with anti-lock braking systems prevent accidents and earn discounts up to 10%.

- Sign Online – A handful of insurance companies will give a small break just for signing your application digitally online.

- More Vehicles More Savings – Insuring multiple cars or trucks on the same insurance policy can get a discount on all vehicles.

It's important to note that most credits do not apply to all coverage premiums. Some only apply to specific coverage prices like comprehensive or collision. So despite the fact that it appears it's possible to get free car insurance, you're out of luck.

Insurance companies that may have these money-saving discounts include:

- Esurance

- The Hartford

- AAA

- GEICO

- State Farm

Check with each company how you can save money. All car insurance discounts might not apply in your area.

Why your Toyota Avalon insurance rates may be high

Smart consumers have a good feel for the factors that play a part in calculating your insurance rates. When you know what positively or negatively influences your rates helps enable you to make changes that may reward you with better insurance rates.

Shown below are some of the items that factor into rates.

- Never allow your policy to lapse – Having an insurance coverage lapse is a fast way to increase your insurance rates. And not only will insurance be more expensive, getting caught without coverage might get you a revoked license or a big fine.Then you may be required to file a SR-22 with your state department of motor vehicles.

- Pay less after the wedding – Getting married can actually save you money on your policy. Having a significant other is viewed as being more mature than a single person it has been statistically shown that married drivers get in fewer accidents.

- Equipment add-ons that lower insurance rates – Choosing a vehicle with an alarm system can save you a little every year. Theft prevention features like LoJack tracking devices, vehicle tamper alarm systems or GM's OnStar system can thwart your car from being stolen.

- Better crash test results mean better rates – Cars with high safety ratings can get you lower premiums. Safer cars have better occupant injury protection and lower injury rates translates into savings for insurance companies and lower rates for you. If your Toyota Avalon has ratings of a minimum four stars on Safercar.gov it is probably cheaper to insure.

- Bump up deductibles to save – Coverage for physical damage, commonly called comprehensive (or other-than-collision) and collision coverage, is used to repair damage to your Toyota. A few examples of covered claims could be a windshield shattered by a rock, vandalism, and burglary. Your deductibles are how much you are willing to pay out-of-pocket if you file a covered claim. The more you have to pay, the bigger discount you will receive for Avalon coverage.

- Bundling policies can get discounts – Most insurers will give a discount to policyholders who buy several policies from them such as combining an auto and homeowners policy. Discounts can add up to five, ten or even twenty percent. Even if you're getting this discount you still need to compare rates to verify if the discount is saving money.

Tailor your coverage to you

When it comes to choosing coverage, there really is not a perfect coverage plan. Everyone's situation is a little different.

For instance, these questions might point out if you will benefit from professional help.

- How many claims can I have before being canceled?

- Will my vehicle be repaired with OEM or aftermarket parts?

- Is my 1999 Toyota Avalon covered for smoke damage?

- How do I file an SR-22 for a DUI in my state?

- Can I afford low physical damage deductibles?

- What if I owe more than I can insure my car for?

If it's difficult to answer those questions but you know they apply to you, you might consider talking to an insurance agent. If you don't have a local agent, complete this form. It's fast, doesn't cost anything and can provide invaluable advice.

Parts of your car insurance policy

Having a good grasp of car insurance can help you determine the best coverages for your vehicles. Car insurance terms can be impossible to understand and coverage can change by endorsement.

Medical payments and PIP coverage

Coverage for medical payments and/or PIP kick in for immediate expenses like rehabilitation expenses, ambulance fees and EMT expenses. They are often used to cover expenses not covered by your health insurance policy or if you lack health insurance entirely. They cover not only the driver but also the vehicle occupants and also covers getting struck while a pedestrian. PIP coverage is not universally available and gives slightly broader coverage than med pay

Liability

Liability insurance protects you from injuries or damage you cause to a person or their property that is your fault. It protects YOU from claims by other people, and does not provide coverage for your injuries or vehicle damage.

Coverage consists of three different limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You commonly see limits of 25/50/25 which means a $25,000 limit per person for injuries, $50,000 for the entire accident, and property damage coverage for $25,000.

Liability coverage protects against claims such as medical expenses, attorney fees, pain and suffering and legal defense fees. How much liability coverage do you need? That is your choice, but consider buying higher limits if possible.

UM/UIM (Uninsured/Underinsured Motorist) coverage

This protects you and your vehicle from other drivers when they are uninsured or don't have enough coverage. Covered claims include medical payments for you and your occupants and damage to your Toyota Avalon.

Due to the fact that many drivers have only the minimum liability required by law, their limits can quickly be used up. So UM/UIM coverage should not be overlooked.

Comprehensive auto coverage

This covers damage caused by mother nature, theft, vandalism and other events. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive can pay for things like rock chips in glass, hitting a deer, a tree branch falling on your vehicle and hitting a bird. The maximum payout a car insurance company will pay at claim time is the market value of your vehicle, so if it's not worth much more than your deductible consider dropping full coverage.

Collision insurance

Collision coverage covers damage to your Avalon resulting from a collision with an object or car. You will need to pay your deductible then your collision coverage will kick in.

Collision can pay for claims such as sideswiping another vehicle, sustaining damage from a pot hole and crashing into a building. Collision coverage makes up a good portion of your premium, so consider dropping it from vehicles that are older. It's also possible to bump up the deductible to bring the cost down.

Shop around and save

You just learned quite a bit of information on how to get a better price on 1999 Toyota Avalon insurance. The key concept to understand is the more times you quote, the higher your chance of finding lower rates. You may be surprised to find that the lowest rates come from an unexpected company.

When shopping online for car insurance, never skimp on critical coverages to save a buck or two. There have been many cases where an insured dropped full coverage and found out when filing a claim that the few dollars in savings costed them thousands. Your goal should be to get the best coverage possible at a price you can afford.

Drivers leave their current company for a number of reasons such as not issuing a premium refund, high rates after DUI convictions, high prices and policy non-renewal. No matter why you want to switch, finding the right car insurance provider can be easy and end up saving you some money.

For more information, feel free to browse the following helpful articles:

- Safe Vehicles for Teens (iihs.org)

- Vehicle Safety Ratings (iihs.org)

- Should I Purchase an Umbrella Liability Policy? (Insurance Information Insitute)

- Rollover Crash FAQ (iihs.org)

- Drunk Driving Statistics (Insurance Information Insitute)

- Property Damage Coverage (Liberty Mutual)

Car Insurance for a 1998 Toyota Avalon Xl Sedan

Source: https://www.quoteinspector.com/1999-toyota-avalon-lowest-insurance-quotes/